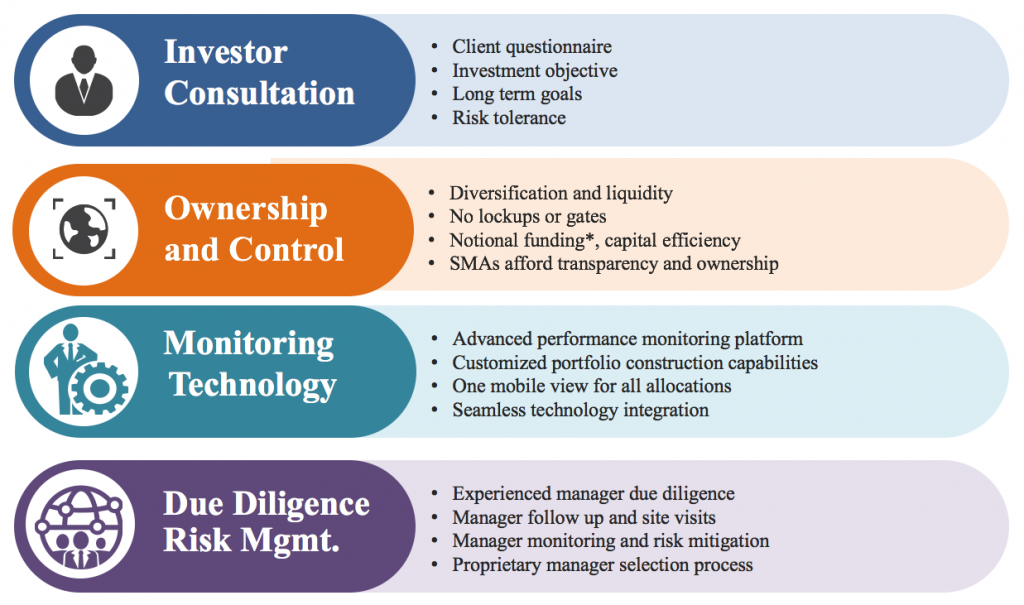

A comprehensive collaboration in portfolio construction and risk mitigation.

- A good alternative investment is one that produces positive risk-adjusted returns (over a reasonable time frame) and exhibits a lower correlation to traditional investments.

- We believe growth managers will outperform mature managers.

- Separately managed accounts provide transparency, control, and risk management monitoring.

- Portfolio diversification begins with manager due diligence and selection process.

- Managed Futures, deployed intelligently across a number of managers, can be an effective compliment to traditional assets.

- Choose PGM Alternatives for your collaborative Managed Futures solution.