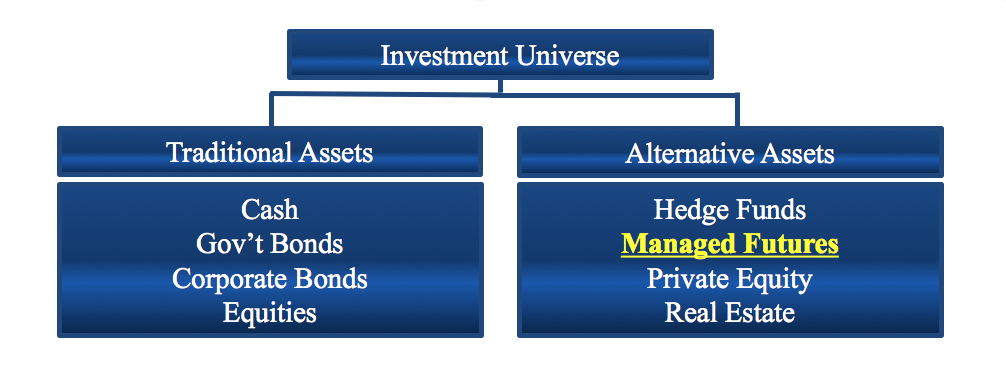

Managed Futures are a distinct asset class in the alternative investment space, separate from traditional investments such as equities and bonds.

Managed Futures provide beneficial diversification from traditional assets.*

Managed Futures represents a broad universe of alternative investment strategies in which portfolio managers, known as Commodity Trading Advisors (CTAs), use futures contracts as part of their investment strategy. Managers seek to generate returns by taking long and/or short positions in financial instruments, currencies and commodities.

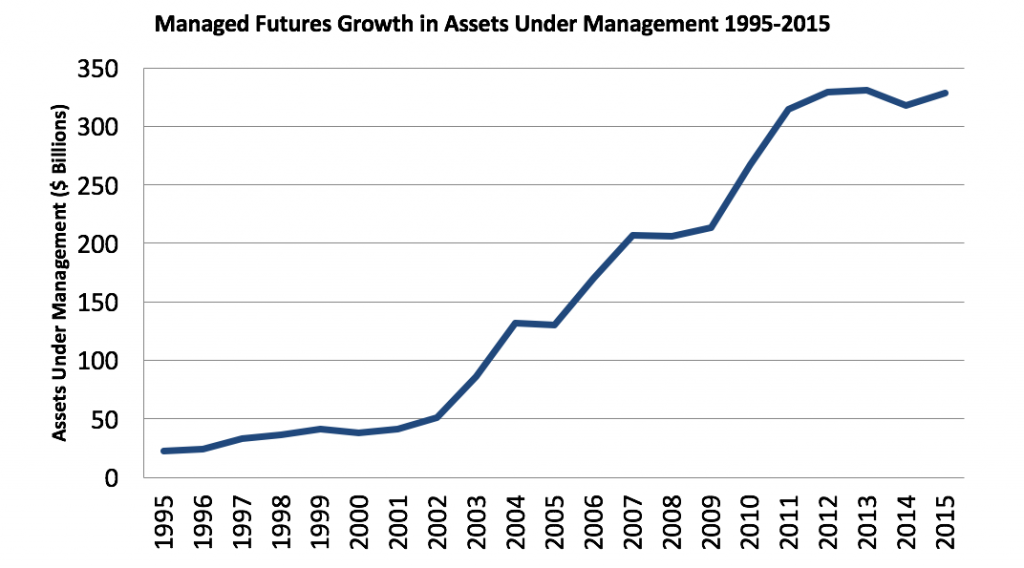

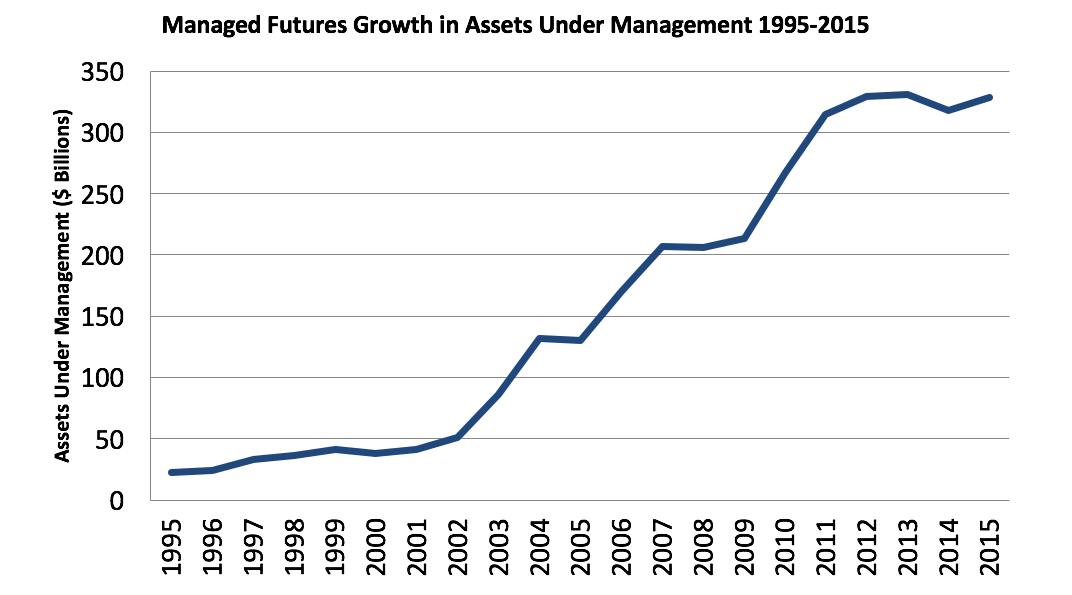

Factors leading to substantial growth in Managed Futures include: expansion of global futures markets, electronic trading, education, and diversity of investment styles.

Source: Barclay Hedge

*While Managed futures can help enhance returns and reduce risk, they can also do the opposite and result in further losses.